Arizona Commercial Lease Agreement Template

An Arizona commercial lease agreement enables the owner of property to lease it out to any willing occupant in need of retail, industrial, and office space. The commercial lease agreement differs from that of a residential lease in the fact that the landlord may not collect rent until the business of the tenant begins earning sufficient money to cover costs. The tenant will also have to gain the landlord’s permission before altering the property in any way.

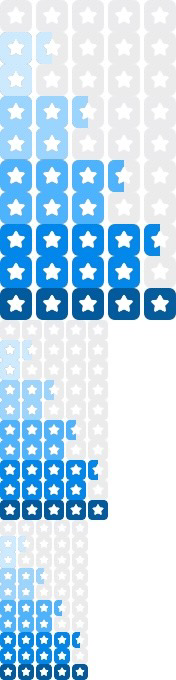

These are the three (3) types of commercial lease agreements:

- Gross – This option is the best situation for the tenant because the tenant is only required to pay a monthly cost, with the landlord paying for all utilities, repairs, taxes, etc.

- Modified Gross – This option lands somewhere between gross and triple net, mixing the costs of the property between the landlord and tenant. The two will typically discuss who pays what regarding the property, before the first monthly payment.

- Triple Net (NNN) – This is usually landlord’s preferred option as it requires that the tenant pay for all major utilities, including water, electricity, heat, parking, taxes, and minor to major repairs.